taxing unrealized gains crypto

If given the power to tax unrealized gains expect the feds to expand. After all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin gains which have.

![]()

Bitcoin Tax Vs Cointracking Vs Cryptotrader Tax Cryptowisser Blog

Approach at crypto tax software application specialist CoinTracker.

. The same was true of the new income tax in 1913. To understand how this. While the US constitution does allow the government to tax income there is a heated debate around the conceptual and material application of taxation over unrealized gains especially.

Speaking to CNN on Sunday the. In a nutshell its a 20 tax on the unrealized capital gains hang on to that thought of American households worth at least 100 million. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet.

Top Crypto Exchanges Without KYC Read Now. The new proposal is framed as a tax on the ultrarich. The tax could make use of a âœmark to.

The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income. On the other hand a tax on unrealized gains could shift from making the government money to costing it money if the downturn is bad enough. Similarly if the price of BTC dropped to.

Talk of a tax on unrealized capital gains has resurfaced. Tax is only incurred when you sell the asset and you subsequently receive either cash or units of. The idea is to tax a portion of the population on their figurative gains.

Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more. But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37. Treasury Secretary Janet Yellen has revealed that the US.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit. Treasury Secretary Wants to Tax Unrealized Crypto Gains. American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi claiming that a wealth tax an.

The Trust Project is an international consortium of news organizations building standards of transparency. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. October 24 2021 1056 PM.

For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. Billionaires may be the first target but a.

If youre holding crypto theres no immediate gain or loss so the crypto is not taxed. With 247 trading and investment minimums as low as 10 its so easy to get started. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful.

You have an unrealized profit of 10000. Including assets such as.

Understanding Crypto Taxes Coinbase

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Crypto Taxation And Regulations In Europe April 2022 Oobit

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

Crypto Tax Unrealized Gains Explained Koinly

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Crypto Tax Unrealized Gains Explained Koinly

Crypto Taxes In 2021 What Should You Know By Changenow Io Medium

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

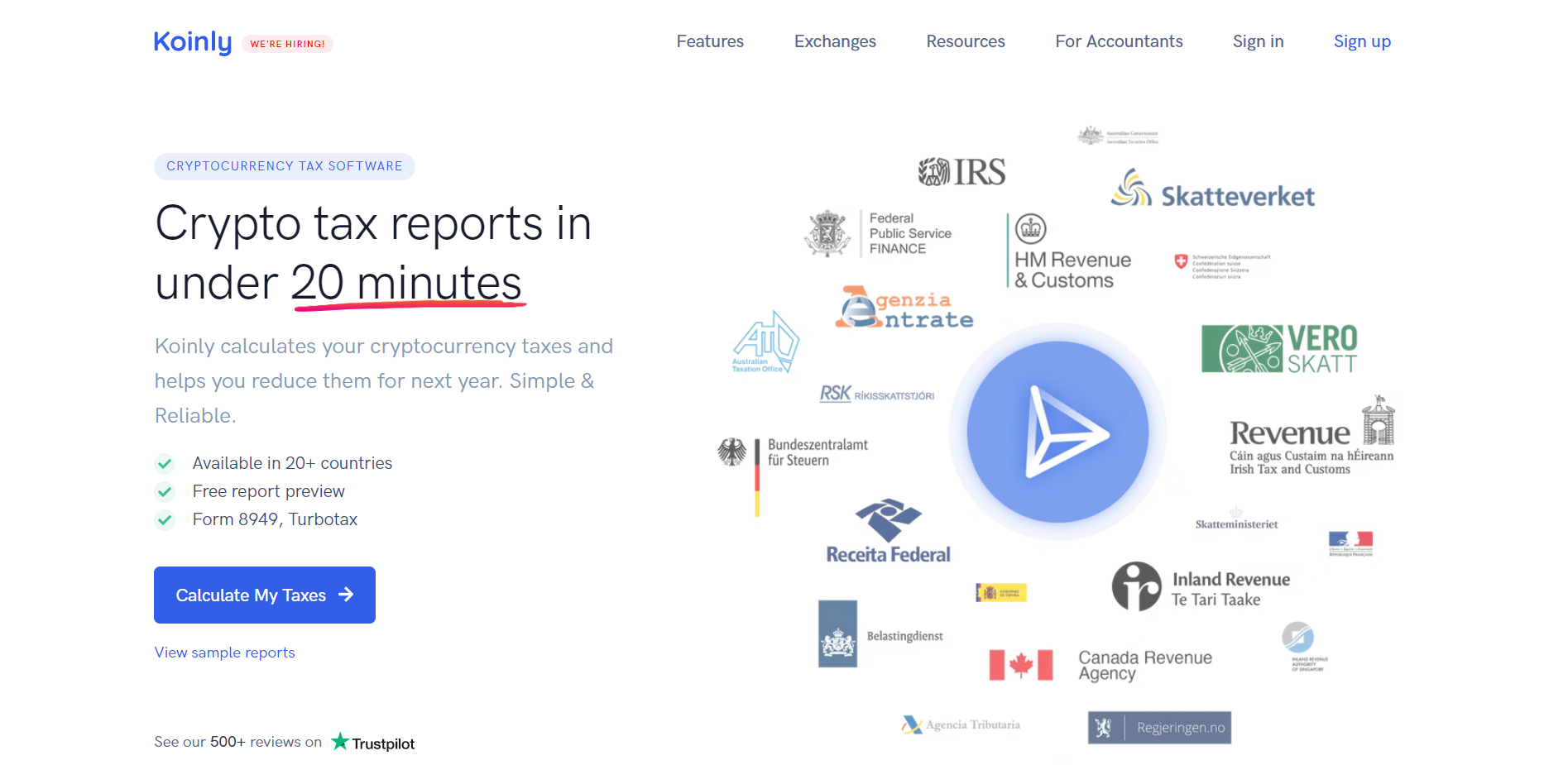

Koinly Offers Novel Platform For Crypto Taxation Integrates Cosmos Xinfin Xdc Blockchains

The Best Crypto Tax Software Of 2022 Ranked Reviewed

Understanding Crypto Taxes Coinbase

Crypto And Bitcoin Taxes Guide 2021 Cryptocurrencies Regulations And Taxation Worldwide

10 Best Crypto Tax Software Apps 2022

Crypto Taxation And Regulations In Europe April 2022 Oobit

Crypto Tax Free Countries 2022 Koinly

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Confusing U S Tax Laws Lead To 5 Billion In Unrealized Crypto Losses