mississippi income tax rate

How to Calculate 2022 Mississippi State Income Tax by Using State Income Tax Table. Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the.

Historical Mississippi Tax Policy Information Ballotpedia

AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut.

. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. When coupled with the 3 percent marginal rate repeal which was fully eliminated at the start of 2022 the Senates bill would result in Mississippi levying no tax on the first. The Mississippi corporate tax rate is changing.

Mississippi sales tax rates. Mississippi Income Tax Calculator 2021. Your average tax rate is 1198 and your marginal.

The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA. However the statewide sales tax of 7 is slightly above the national average.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. Find your income exemptions. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination.

Detailed Mississippi state income tax rates and brackets are available on this page. But if legislators take no action the tax rate will remain at 4. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Moving to a flat four percent income tax puts more than 500 million in recurring dollars back in taxpayers pockets and makes Mississippi one of the most competitive in the. Details on how to. Individual Income Tax.

Compare your take home after tax and estimate. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mississippis sales tax rate.

There is no tax schedule for Mississippi income taxes. Mississippi residents have to pay a sales tax on goods and services. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination.

All other income tax returns. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5 percent on anything beyond. Mississippi has a graduated tax rate.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least. The income tax in the Magnolia State is. Find your pretax deductions including 401K flexible account.

First and foremost is the way it treats retirement income. Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020. These rates are the same for individuals and businesses.

Mississippis maximum marginal corporate income tax rate. To amend section 27-7-5 mississippi code of 1972 to reduce the state income tax on the taxable income of individuals. Mississippi Income Tax Forms.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. If you are receiving a refund.

Outlook for the 2021. An act to create the mississippi tax freedom act of 2022. The graduated income tax rate is.

2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

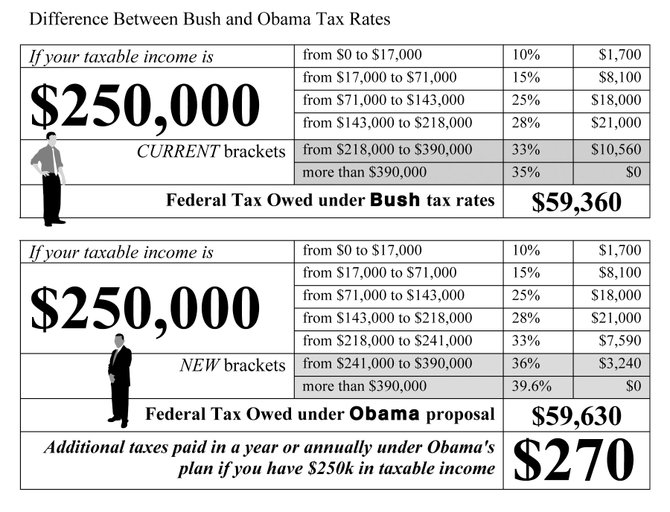

Taxes Obama Vs Bush Rates Jackson Free Press Jackson Ms

Mississippi Tax Rate H R Block

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

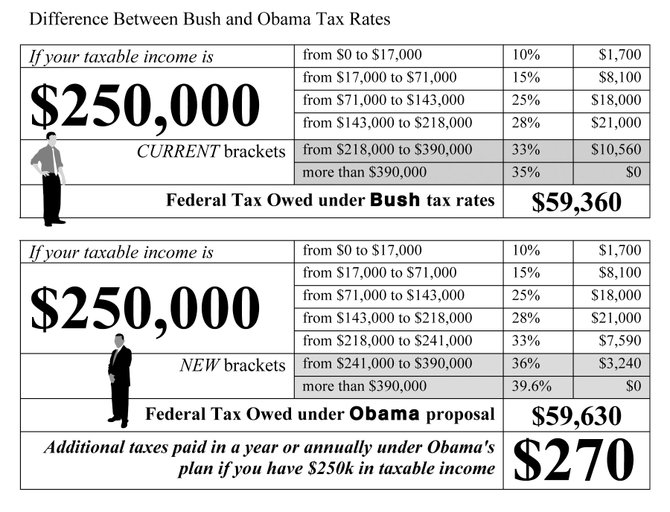

Top State Corporate Income Tax Rates In 2014 Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Report Shows Mississippi 7th Highest In State Local Tax Burden Mississippi Politics And News Y All Politics

Mississippi Tax Rate H R Block

Mississippi State Tax H R Block

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Strengthening Mississippi S Income Tax Hope Policy Institute

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Calculator Smartasset

Mississippi Who Pays 6th Edition Itep

Tax Rates Exemptions Deductions Dor

Individual Income Tax Structures In Selected States The Civic Federation

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

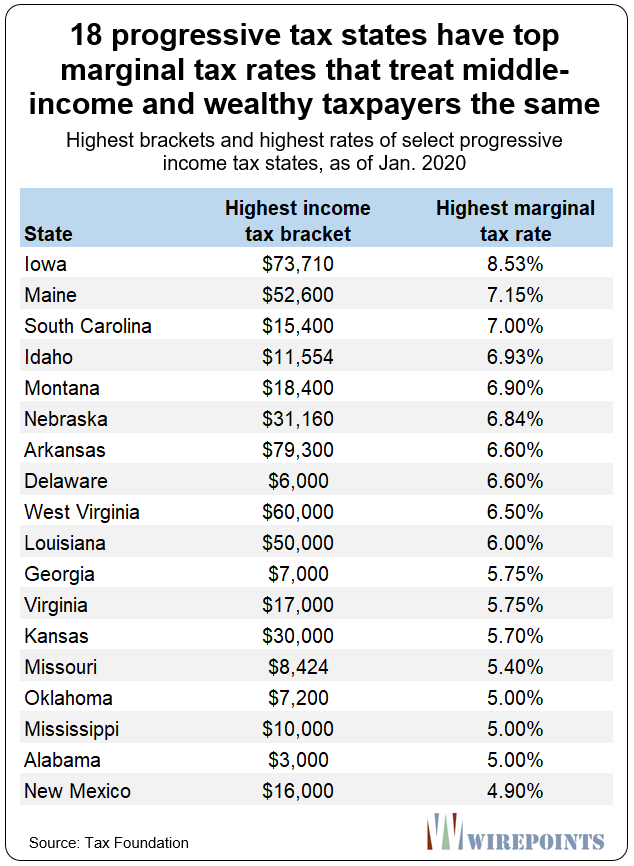

18 Progressive Tax States Have Top Marginal Tax Rates That Treat Middle Income And Wealthy Taxpayers The Same1 Wirepoints